Loans For Minority by KSMDFC. ന്യൂനപക്ഷത്തിനുള്ള വായ്പകൾ ? Benny Kochery.

ന്യൂനപക്ഷത്തിനുള്ള വായ്പകൾ ?

Registered Office/Head Office.

Its registered office is at Ground Floor, KURDFC Building, Chakkorathkulam, West Hill P.O, Kozhikode – 673572, Kerala. Ph: 0495 2769 366, 2369 366, 2368 366. Email: [email protected]

Our Other Offices

1. Thiruvananthapuram Regional Office – 2nd Floor, Samastha Jubilee Building, Melethampanoor, Thiruvananthapuram – 695 001, Ph: 0471-2324 232. Email: [email protected]

2. Ernakulam Regional Office – 1st Floor, Minority Coaching Centre Building, Bank Junction, Aluva, Ernakulam – 683 101, Ph: 0484-2627 655. Email: [email protected]

3. Malappuram Regional Office – 1st Floor, Sunni Mahal Building, Jubilee Mini Bypass Road, Perinthalmanna, Malappuram – 679 322, Ph: 04933-297 017. Email: [email protected]

4. Kasaragod Regional Office – Ground Floor, Bus Stand Building, Cherkala, Chengala (PO), Kasaragod – 671 541, Ph: 04994-283 061. Email: [email protected]

SCHEMES AND PROGRAMMES

1 :SELF EMPLOYMENT SCHEME FOR MINORITIES

INCOME CRITERIA The annual family income below Rs.98,000/- in rural area and Rs. 1,20,000/- in urban area.

AMOUNT LIMIT The maximum amount that can be disbursed under this scheme will be Rs. 20.00 lakh.

RATE OF INTEREST 6%

REPAYMENT PERIOD 60 Months

AGE LIMIT Between 18-56

2: SELF EMPLOYMENT SCHEME FOR MINORITIES CREDIT LINE 2

INCOME CRITERIA The annual family income must be below Rs.600000/-

AMOUNT LIMIT The maximum amount that can be disbursed under this scheme will be Rs.30.00 lakh.

RATE OF INTEREST 6% for female and 8% for male

REPAYMENT PERIOD 60 months

AGE LIMIT Between 18-56 years

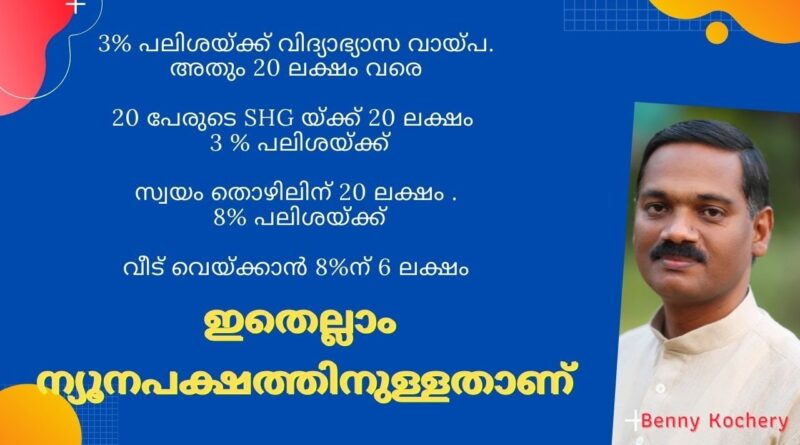

3: EDUCATIONAL LOAN SCHEME FOR MINORITIES (NMDFC SCHEME)

INCOME CRITERIA The annual family income must be below Rs.98,000/- in rural area and Rs. 1,20,000/- in urban area.

AMOUNT LIMIT The maximum amount that can be disbursed under this scheme will be Rs.20 lakh.

RATE OF INTEREST 3%

REPAYMENT PERIOD 60 months

AGE LIMIT Between 16-32 years as on the date of application

4: EDUCATIONAL LOAN SCHEME FOR MINORITIES (NMDFC SCHEME)

INCOME CRITERIA The annual family income must be

below Rs. 600000/-

AMOUNT LIMIT Rs.20.00 lakh.

RATE OF INTEREST The interest rate will be 5% for girls and 8% for boys

REPAYMENT PERIOD 60 months

AGE LIMIT Between 16-32 years as on the date of application

5 MICRO FINANCE SCHEME

INCOME CRITERIA The annual family income must be below Rs.98,000/- in rural area and Rs. 1,20,000/- in urban area.

LOAN AMOUNT LIMIT Up to Rs.1.00 lakh per member of SHG, Up to Rs.20.00 lakh for a group of 20 members in one SHG

RATE OF INTEREST 2% 3% for female and 5% for male

6: SELF EMPLOYMENT SCHEME FOR MINORITIES

INCOME CRITERIA The annual family income must be below Rs.15.0 lakh

AMOUNT LIMIT Rs.20 Lakh.

RATE OF INTEREST 8%

REPAYMENT PERIOD 84 months

AGE LIMIT Between 18-58 years as on the date of application

7: EDUCATION LOAN(PARENT PLUS)

INCOME CRITERIA NO INCOME LIMIT

AMOUNT LIMIT Rs.10.00lakh

RATE OF INTEREST 7%

REPAYMENT PERIOD 60 months

AGE LIMIT Below 55 years as on the date of application

8: BUSINESS DEVELOPMENT LOAN FOR MINORITIES

(KSMDFC SCHEME)-

INCOME CRITERIA The annual family income below Rs.15.00 lakh

AMOUNT LIMIT Rs.5.00Lakh.

RATE OF INTEREST 8%

REPAYMENT PERIOD 60 months

AGE LIMIT Between 18-55 years

9: PRAVASI LOAN SCHEME

INCOME CRITERIA The annual family income must be below Rs.81000/- in rural area and Rs. 103000/- in urban area.

AMOUNT LIMIT Rs.10.00Lakh.

RATE OF INTEREST 5%

REPAYMENT PERIOD 84 months

AGE LIMIT Between 18-58 years

10: VISA LOAN SCHEME (KSMDFC SCHEME) FOR MINORITIES TO FIND JOB IN FOREIGN COUNTRIES

INCOME CRITERIA The annual family income must be below Rs.81000/- in rural area and Rs. 103000/- in urban area.

AMOUNT LIMIT Rs.3Lakh.

RATE OF INTEREST 5%

REPAYMENT PERIOD 84 months

AGE LIMIT Between 18-58 years

11: MULTI-PURPOSE LOAN FOR EMPLOYEES

INCOME CRITERIA This loan is restricted to class IV government employees only

AMOUNT LIMIT Rs.5.00 Lakh.

RATE OF INTEREST 9%

REPAYMENT PERIOD 60 months

AGE LIMIT Between 18-55 years

12: HOUSING LOAN SCHEME FOR MEMBERS OF MADRASA TEACHERS WELFARE FUND

INCOME CRITERIA The annual family income below Rs.98,000/- in rural area and Rs. 1,20,000/- in urban area.

AMOUNT LIMIT Rs.2.5 lakh/-

RATE OF INTEREST NIL

REPAYMENT PERIOD 84 months

13: GENERAL HOUSING LOAN SCHEME

INCOME CRITERIA The annual family income below Rs.6.0 lakh/- AMOUNT LIMIT Rs.6.00 lakh

RATE OF INTEREST 8%

REPAYMENT PERIOD 84months

14: LOAN SCHEME FOR MINORITY EDUCATION INSTITUTION

AMOUNT LIMIT Rs.10.00 lakh

RATE OF INTEREST 9%

REPAYMENT PERIOD 84months

source