A History Of Black Banks From 1930-Present

“Banking on Self-Reliance” continues … with Black bankers and communities pushing forward in their quest for financial freedom after the Freedman’s Savings Bank folded. Get into the history of Black banks from 1930 to the present:

“Solid as the ‘Rock of Gibraltar’”

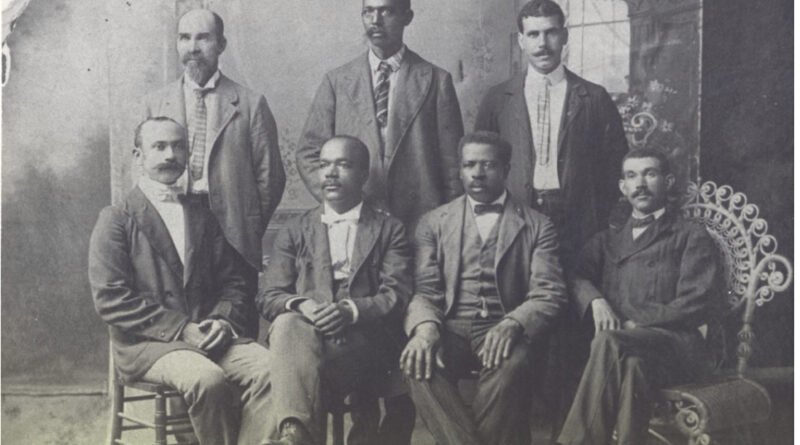

The resilience of the Black banking enterprise remained unbroken even in the face of the Freedman’s Bank’s failure and the Panic of 1873, which was felt for several years and contributed to the Long Depression, a period of economic stagnation in the United States and other parts of the world. Between 1882 and the Great Depression, there was a remarkable surge in the establishment and growth of Black banks in America.

In a climate where white-owned institutions withheld credit and capital from Black businesses, it was the Black churches, mutual aid societies, and fraternal organizations that emerged as the bedrock of Black communities, much as they had been for free Blacks in the North during the pre-Civil War era.

Utilizing assets such as real estate, buildings, and Sunday offerings, the churches not only fostered wealth for their own ministries, including schools, but also channeled capital into Black-owned banks, insurance companies, newspapers, and various other business ventures. This collective effort catered to the needs of Black communities and contributed to the flourishing of a vibrant economy. The first generation of Black bankers worked hard to demonstrate their incalculable worth to their communities.

“It has often been stated that not many depositors have suffered from the failing of a Negro bank in the United States,” The Nashville Globe reported in 1910 as it reflected on the fallout over the Freedman’s Bank. “Thus this first failure right in the door of the nation’s capital has served to strengthen the confidence as well as to educate the Negro in the financial world.”

The paper also noted, out of the scores of failures reported by the press during the Banker’s Panic of 1907, “not one was chalked up against the Negro Bank. Their annual statements, instead of showing a decrease in clearance, showed an increase.” Black banks were as “solid as the ‘Rock of Gibraltar.’”

Black banks emerged as a formidable presence in numerous thriving cities.

During the first decade of the 20th century, over 60 prosperous Black banks dotted the urban landscape of the South. Like ethereal mushrooms, these institutions seemed to sprout overnight, garnering attention from newspapers of all shades, whether Black or white. Maryland, Virginia, North Carolina, Georgia, Florida, Alabama, and Mississippi stood as the very backbone and sinew of the Black banking industry, with Virginia boasting an impressive 13 banks and Mississippi with 11. The Nashville Globe, in 1909, revealed that Mississippi’s Blank banks had witnessed a staggering increase in total assets, soaring from $50,000 in 1904 to an impressive $750,000 by 1908.

In their nascent days, these early Black banks bore names that evoked purpose and resilience: One Cent Savings Bank in Nashville, Solvent Savings in Memphis, People’s Investment in Birmingham, The Sons and Daughters of Peace, Penny,

Nickel and Dime Savings in Newport News, and the Star of Zion Banking and Loans Association in Salem, Virginia.

Banking and insurance, long revered as the pinnacle of business pursuits, have always commanded utmost diligence and financial acumen. As such, prevailing notions of Black intellectual inferiority and unfounded associations with criminality denied Black people the chance to acquire financial knowledge within the domain of white establishments. White banks limited the prospect of Black individuals to menial roles as janitors while withholding their patronage. In stark contrast, within the realm of Black banking institutions, the spectrum of stockholders spanned from tender two-year-old children to seasoned elders, fostering a remarkable inclusivity, and embracing the wisdom and aspirations of all generations.

From The Denver Star, May 1914: “How he has succeeded in mastering the banking and insurance businesses without opportunities to learn is almost a great wonder . . . That he has learned the banking and insurance businesses, has developed them, and is now conducting these branches of business with success constitutes one of the best possible answers to the statements by anti-race men that the Negro is an inferior race.”

During this era, a constellation of pioneering Black banks graced the financial landscape. Notable among them was the Capital Savings Bank, established in 1888 in the heart of Washington, D.C. It stood as a testament to Black excellence, being the first bank conceived and operated by African Americans. Within four years of opening, the bank’s deposits burgeoned to surpass the remarkable sum of $300,000.

That same year, the True Reformers Bank of Richmond was established under the visionary leadership of Rev. William Washington Browne, a former slave and Union Army officer from Georgia. Born from the inspiration of the Grand Fountain United Order of True Reformers, a revered Black fraternal organization founded by Browne, this financial institution emerged as a response to an arduous challenge.

The initial intent had been to establish a local branch of the fraternal organization in Virginia, and its savings were entrusted to the care of a white storekeeper. But the scourge of racial tensions, stoked by a lynching in Charlotte County, aroused suspicions among local whites regarding the organization’s intentions with the funds. Determined to safeguard their finances from white scrutiny, Browne made

the pivotal decision to open a bank catering exclusively to Black clientele in Richmond. The bank flourished and expanded its reach across more than 20 states, an enduring testament to its legacy.

In 1889, the Mutual Bank and Trust Company of Chattanooga took its place among these venerated institutions, followed shortly thereafter by the establishment of the Alabama Penny Savings Bank of Birmingham in 1890. Another notable addition to this illustrious roster was the North Carolina Mutual Life Insurance Company, which found its footing in 1898 and swiftly amassed a remarkable quarter of a million dollars in revenue by 1910. Today, it proudly stands as one of the oldest and most distinguished Black-owned insurance companies in the United States.

The Mutual Bank and Trust Company of Chattanooga was established in 1889, followed by the Alabama Penny Savings Bank of Birmingham in 1890. Drawing inspiration from the biblical tale of the virtuous servant who returned with ten talents after being entrusted with five, William Rueben Pettiford established the Alabama Penny Savings Bank. When he established his bank, incredulous white men did not regard it as serious enough to last and many Black folks regarded it with distrust. By 1914, his magnificent building at 310 18th Street North was the home of over $500,000 in resources and regular annual dividends paid, attesting to its wise and prudent management. Inspired by the success of this bank, others sprung into existence in other states.

The North Carolina Mutual Life Insurance Company, which was established in 1898, grossed a quarter of a million dollars by 1910 and stood as one of the oldest and most prominent Black-owned insurance companies in the US until 2022 when it came to an end.

The year 1900 bore witness to the founding of The National Negro Business League by the visionary Booker T. Washington. It 1966, it would be reborn as The National Business League, leaving an indelible mark on the landscape of Black entrepreneurship. This influential league provided unwavering support to Black visionaries, nurturing the growth and prosperity of their enterprises. Its impact resonated across the nation, with an impressive network of 600 chapters established throughout the United States.

“The Negro Yearbook,” a diligent chronicler of Black banks, revealed a captivating glimpse into their ascendancy. By 1912, 64 Black banks were thriving, collectively doing annual business of about $20 million as these institutions

increasingly earned community trust. Meanwhile, the National Negro Bankers Association, established in 1924 by Richard Wright, Sr. and Charles C. Spaulding, held annual meetings of Black bankers to discuss cooperation and to exchange information on how to foster cooperation between Black business and banks.

The Colorado Statesman newspaper said, “The Negro banker is about the safest banker on earth. He knows that strong forces are against him, not because he’s a Negro, but because he is a competitor in the sanctum sanctorum of modern power; he knows, too, that the world is watching him and that he has to depend for business on a people many of whom would rather for their money to gown in the crash of a white bank than to be safe in a Negro bank. In other words, the negro banker has more to gain by being straight and more to lose by crookedness than any other class of bankers in the world.”

“Let us put our moneys together.”

The early decades of the 20th century embodied a period of experimentation and a “golden era of Black banking.” Within the pages of Black newspapers, resounded the resolute calls for a Negro Banking Directory, a symbol of unity that aimed to retain Black wealth within Black institutions and communities. These newspapers urged Black banks to join hands with the media, weaving a tapestry of advertisement to showcase their invaluable services within Black communities.

From The Nashville Globe: “The Negro is handling many thousands of dollars monthly that could be passed through Negro banks in their various communities. They are handling hundreds and thousands of dollars annually that go through post office money orders and by registered mail that could easily be transferred by exchange checks from Negro banks if the public knew that such institutions were in existence and were doing a general banking business.”

In a 1910 interview with The Colorado Statesman, Rev. Pettiford, the president of the Alabama Penny Savings Bank of Birmingham, said that “the greatest problem of the banking institutions conducted by the race was to educate our people to know the purpose and appreciate the value of these institutions.”

Collaboration was deemed indispensable for all Black individuals involved in the field of banking, as emphasized by early leaders. As the Great Depression loomed closer, the urgency of these calls for unity grew louder. Richard Wright, Sr. foresaw that without such a collective alliance, the Black banking sector would struggle to rebound from the impending financial devastation.

“We must unite all the Negro banks in the country to restore confidence in our business. No bank can stand alone,” Wright wrote in 1932.

In the captivating history of Black banking, where the narratives of Black men have often taken center stage, the vital contributions of Black women emerge as a beacon of empowerment, resilience, and defiance against racial and gender discrimination.

One notable figure in this history is Maggie Lena Walker, who became the first female bank president. In 1903, she founded the St. Luke Penny Savings Bank in Richmond, Virginia.

With a resounding call to action, Walker urged, “Let us use our moneys; let us put our moneys out at usury among ourselves and reap the benefit ourselves. Let us have a bank that will take the nickels and turn them into dollars.”

Eliza Allen, a former slave, co-founded the True Reformers Bank in Richmond. Her remarkable leadership extended to creating secret societies of enslaved women, providing vital mutual aid. She holds the distinction of being the sole woman named on the charter of the first Black-owned bank in the United States, the True Reformers Savings Bank.

Mabel Z. Mollison was the first African American female cashier of the Lincoln Savings Bank in Vicksburg, Mississippi, from 1892 to 1908, where she was responsible for all the bank’s financial transactions and served as its public spokesperson.

The Nashville Globe lauded Walker’s astuteness, portraying her as a formidable force capable of navigating any challenge that might arise. Walker “has proven by her wise manipulations in the money market to be equal to any and every emergency that should or could arrive.” Meanwhile, it described Mollison the “moving spirit” in the Lincoln Savings Bank, a testament to her influential role in shaping its success.

Lillian H. Payne, dubbed “the Banker’s Banker,” co-founded the People’s Savings Bank in Kansas City in 1904 and helped it become one of the largest Black-owned banks in the country at that time.

The Depression of the 1930s and its painful global economic impact hindered the progress of many Black banks and led to the closure of several institutions. However, this period of adversity proved to be a transformative moment for Black businesses, as they gleaned a crucial lesson: the importance of financial strategies such as mergers, cost reduction, cooperative collaboration, resource pooling and more scientific management practices.

“Deposit your money in a Black bank”

Calls to entrust wealth to Black banks echoed during the transformative era of the Great Migration when millions of Black people left the South in search of better lives in cities of the North and Midwest. It was in these urban landscapes where racial barriers enforced by white-dominated financial institutions propelled Black banks to the forefront, catering to an expansive market of migrants seeking avenues to acquire homes and establish enterprises.

Fast forward to the resounding voices of the 1960s and 1970s, when the Civil Rights movement spurred an impassioned rallying cry for support of Black banks. Rev. Martin Luther King, Jr., in his powerful orations, urged communities to redirect their financial allegiance from white banks to Black-owned institutions. “Take your money out of the banks downtown and deposit your money in a Black bank,” he preached.

“Take your money out of the banks downtown and deposit your money in a Black bank.” -Rev. Dr Martin Luther King Jr.

Malcolm X, with penetrating clarity, questioned why outsiders should dictate the financial destiny of Black communities, “Why should white people be running the banks in our community?” Meanwhile, the Black Panthers rallied communities behind black businesses that nutured and fortified their neighborhoods:

“Support the businesses that support our communities.”

By the late 1970s, a tapestry of over 50 Black-owned banks were in operation in the United States. Although their numbers endured the tumult of the 1980s savings and loan crisis and the subsequent trials of the Great Recession, which inflicted immense hardships on Black households through foreclosures and equity losses, those that persevered emerged as crucial anchors in their communities, deploying resources with a profound understanding of the unique needs of Black businesses, homeowners and nonprofit organizations.

This rich and enduring history of Black banking teaches us a profound truth as we celebrate Juneteenth: in the absence of Black banks, the essential needs of our communities remain unmet, as they often represent the sole source of equitable and compassionate financial support. Embracing the philosophy of relationship banking, these institutions delve beyond mere credit scores, embracing a holistic comprehension of their customers’ financial circumstances, thereby serving as a vital and irreplaceable lifeline for individuals and Black enterprise in America.

Celebrate Juneteenth 2023 with BLACK ENTERPRISE with month-long content that explores the history of prosperity and banking, and the future of investing and financial literacy for Black communities.

RELATED CONTENT: 10 Black Entrepreneurs Share The Profound Spirit Of Juneteenth In Business